About Us

AVENTURE CAPITAL is Team of Chartered Accountants, CPA & Other Experienced accountants.

Our outsourcing team is trained under Australian accountants, and we provide frequent training to our staff so that they stay up to date with Australian standards. Our motto is to make “Outsourcing – a key for growth & success” to your business in Australia”.

What is outsourcing?

Outsourcing is the business practice of hiring a party outside a company to perform services or create goods that were traditionally performed in-house by the company’s own employees and staff.

Why should your business consider outsourcing?

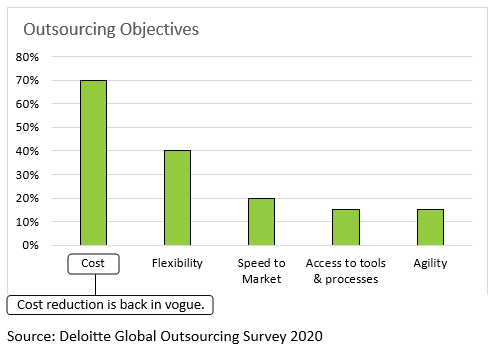

Reduce Cost

How does outsourcing reduce costs and save money?

What is happening now-a-days for many business owners is that they have to give more time to their business not for business growth but keeping up their business. They want or require a staff but due to high labour cost, they choose to manage themselves. The situation is getting tougher and tougher day by day.

Hiring new staff is an expensive process. Even, the Businesses decide to higher more employees which means they may need a bigger office space, more IT equipment and other associated overheads, which ultimately will increase fixed costs. Even if you consider remote work, there may still be a need to invest in data security measures or provide technology to facilitate a work-from-home model. These additional staffing costs can be crippling and quickly outweigh the increased sales or revenue that having additional employees may generate.

Outsourcing allows additional work to be completed, at significantly reduced costs, especially when outsourcing offshore to a lower cost economy, such as India, where employment costs are up to 60% less.

Our outsourcing model takes care of all these costs including recruitment, human resources, new office equipment, superannuation, payroll tax, workers compensation, IT and overall management supervision.

Improved Staff Satisfaction Rates

How does outsourcing improve staff satisfaction?

Outsourcing can help you to identify roles and tasks that would be best suited to send to an offshore employee. That way, your local team can focus on what they do best and what motivates them, improving job satisfaction for employees in the long run.

Hiring offshore team members can help relieve any unnecessary stress felt by your local team through the provision of additional support. Your staff will appreciate this, job satisfaction will increase and attrition will decrease.

Business Growth

How does outsourcing foster business growth?

Australian Businesses are facing two-way problems. One side they have high competition and hence, they are unable to increase the sell price, while on the other side, they face high labour cost. This situation put Australian Business in a very tight cashflow issue. Also, they will not be able to invest in additional resources to support growth objectives. Businesses often don’t have the time to recruit a new employee to leverage potential growth opportunities. On top of this, there are businesses that go through peak periods where there is too much work and then times when there isn’t as much. Outsourcing provides scalability during these times.

Business Flexibility & Availability

How does outsourcing improve business flexibility and availability?

Hiring offshore staff can help businesses manage seasonal and cyclical changes easily. This flexibility can help your business navigate risks, support sustainable business growth and plan for peak periods where additional support may be required. Outsourcing in low-cost economies can also help many businesses extend their hours beyond 9-5 pm, 5 days a week and potentially support 24/7 operations in key areas such as customer service or IT support.

Transparency

A key to a successful outsourcing relationship is “outsourcing transparency,” which requires communication between the two parties on priorities and information requirements. Transparency is the practice of being open and honest with others, no matter how challenging it might be. Our focus will be provide dedicated staff

The pros and cons of outsourcing

As with any good business decision, it starts with weighing the pros and cons so you can make an informed choice whether outsourced bookkeeping is right for you.

Pro #1: Cost Effective

Hiring an outsourced bookkeeping service is more cost effective and less risky than hiring an in-house bookkeeper to handle the books. By outsourcing, you don’t have any additional overhead costs that an employee would generate, such as Super, annual leave, health insurance, vacation, sick pay and workers’ comp. Also, a single person might not have all the answers to complex/more advanced bookkeeping issues while an outsourced team has a number of experts who support each other and can share knowledge to provide the best solution for your needs.

Con #1: Hidden Costs

As with any paid service, additional costs can become a problem if a task is more complex than you initially anticipated resulting in unforeseen costs. The best way to manage this is by talking to your bookkeeper about this to understand and set expectations around any work.

SOLUTION: We are upfront about cost and the best way to manage this is by talking to your bookkeeper about this to understand and set expectations around any work.

Pro #2: A Proactive Approach

As a business owner, you didn’t go into business to become a trained financial professional who lives in the books. Your focus is on serving your customers and growing your business to secure your desired lifestyle. Hiring an external bookkeeping firm ensures that any red flags are spotted ahead of time including cash flow issues and over expenditure. Having a team of experts care for your financial data gives you peace of mind and the confidence to continue forward knowing you won’t run into any unforeseen financial trouble down the road.

Con #2: Less Control

Having an external team of bookkeepers to support you does come with a downside, you can’t simply walk into the office next door and get the rundown on how finances are tracking. Instead, you’ll have to schedule a call or arrange a meeting which does mean updates aren’t instantaneous. Outsourcing your financial data can also feel daunting for a lot of business owners so make sure you do your homework and work with a trusted partner before making a final decision.

SOLUTION: No need to schedule a meeting, you either call or send email to us and we will respond to your query within 24 hours. Also, we will be in touch with you often to get details from you or give you an update about your accounts. It will be same experience all business owners had when their in-house staff were working from home.

Pro #3: Reduced Fraud

Fraud is a concerning aspect for any small to medium sized business owner when they allow a single person to control the books. Small transactions can easily go unnoticed and the books can get manipulated to appear normal for years. It’s a mistake to blindly trust employees, even if you have a strong relationship together as it can lead you into a false sense of security that leads to heartache down the road.

Outsourcing your bookkeeping means no single person controls the books and with multiple pairs of eyes monitoring transactions significantly reduces the risk of fraud and any accounting anomalies.

Con #3: Not Local

There are a lot of overseas bookkeeping and business service providers based overseas. The biggest risk is these companies are not always aware of Australia’s tax laws, BAS statements, superannuation, GST or payroll requirements leaving you open to harsh penalties. In addition, overseas agencies can often be more challenging to communicate with and explain your financial data in a way that makes sense. It’s important to weigh up if outsourcing overseas is the right long term strategy. Alternatively, a more effective and risk free option is to hire an Australian Based Outsourced Team.

SOLUTION: We are Australia based accountants and bookkeepers who are fully aware about Australian Laws and will be reviewing all your accounting and reporting. We will have overseas data entry operators (accounting background) who will be punching data into software.

Pro #4: Training

Bookkeeping firms are legally obliged to stay up to date with the latest Government regulations and tax laws to ensure proper compliance and best practices. As a business owner, this is important as you want to ensure your books are managed as per the ATO’s regulations even when those regulations are updated. Working with an outsourced bookkeeping company gives you that peace of mind.

Accountants

- Balance Sheet.

- Financial pre-Audit review & preparation.

- Tax Return preparation

Bookeepers

- Data Entry for Sales, Purchases, Other Income

- Trial Balance.

- Ledger Management.

Administrators

An administration assistant is responsible for performing all day-to-day administrative functions of a

HR & PAYROLL OFFICERS

- Writing and placing job ads

- Writing and updating job descriptions

Data Entry Officers

A data entry officer is a professional who sorts and processes data for an organisation.

We’re your finance and business experts. Contact us today and help is on the way!